Dear Senator Durbin and Senator Wyden:

We are writing to express our strong support for S. 1314, the Tobacco Tax Equity Act of 2021, which would increase the federal excise tax on cigarettes and set federal tax rates for other tobacco products at an equivalent level. This legislation would generate substantial benefits to public health by helping prevent young people from starting to use tobacco products and helping current users to quit. At the same time, it would increase federal revenues, including by closing existing tax loopholes that have created incentives for tax avoidance.

Our organizations strongly support increasing and equalizing tobacco taxes. The evidence is clear that raising tobacco prices, including through higher taxes, is one of the most effective ways to reduce tobacco use, especially among youth, who are more sensitive to changes in price than adults. Decades of economic studies and Surgeon General reports show that significantly increasing the prices of tobacco products can reduce and prevent youth use of tobacco products. We estimate that the bill’s doubling of the federal cigarette tax would reduce the number of adult smokers by 1.1 million in the first year and would, over time, avoid 250,000 smoking-related premature deaths. It would also prevent 507,000 kids alive today from becoming smokers, which would further reduce smoking-related disease and premature death.

Increasing tobacco taxes will also help reduce health disparities. Americans with lower levels of education and income disproportionately experience the substantial health and financial burdens of smoking. The U.S. Centers for Disease Control and Prevention, the Task Force on Community Preventive Services, the World Health Organization, and other health experts recognize that these individuals will be more likely to quit due to a tobacco tax increase. Nearly half of the lives saved due to smoking reductions from the most recent federal tobacco tax increase in 2009 will be among those below the poverty line.

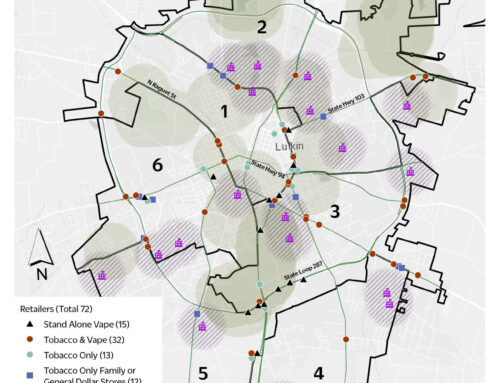

The federal tobacco tax code has not kept up with the latest generation of tobacco products on the market. E-cigarettes, which are currently not taxed at the federal level, are by far the most popular tobacco product among youth, and the U.S. Surgeon General and the Food and Drug Administration have called youth use of e-cigarettes an “epidemic.” In 2020, 3.6 million middle and high school students were currently using e-cigarettes, including 19.6 percent of high school students. In 2018, the Surgeon General called for “aggressive steps to protect our children from these highly potent products that risk exposing a new generation of young people to nicotine.” The federal tax on e-cigarettes that your bill would establish is a long overdue response to the youth e-cigarette epidemic.

Furthermore, the current federal tobacco tax code contains loopholes that have created incentives for tax avoidance. The Government Accountability Office (GAO) has highlighted how certain manufacturers have avoided paying higher taxes on roll-your-own tobacco by re-labeling the product as “pipe” tobacco, which is taxed at substantially lower rates under the current tax code. The GAO also noted that some manufacturers have avoided the higher tax rates for cigarettes and small cigars by slightly modifying their products to qualify as large cigars. The GAO estimates that federal revenues lost as a result of these two loopholes ranged from $2.6 billion to $3.7 billion from April 2009 through February 2014. By equalizing tax rates for all tobacco products, your bill would eliminate existing tax loopholes and generate additional revenue.

Federal tobacco tax rates have not increased in more than a decade, and the tobacco product landscape has changed significantly during this time. It is long past time that we implement this evidence-based policy again to reduce tobacco use and save lives. We applaud the introduction of this bill and appreciate your support for reducing tobacco’s terrible toll on our nation’s health.